ending work in process inventory formula

Work in process WIP inventory refers to materials that are waiting to be assembled and sold. For this reason its considered best practice to hold.

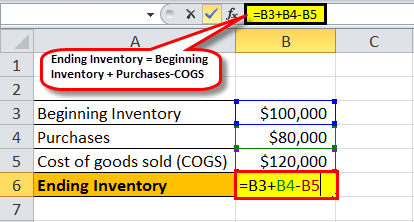

Ending Inventory Formula Calculator Excel Template

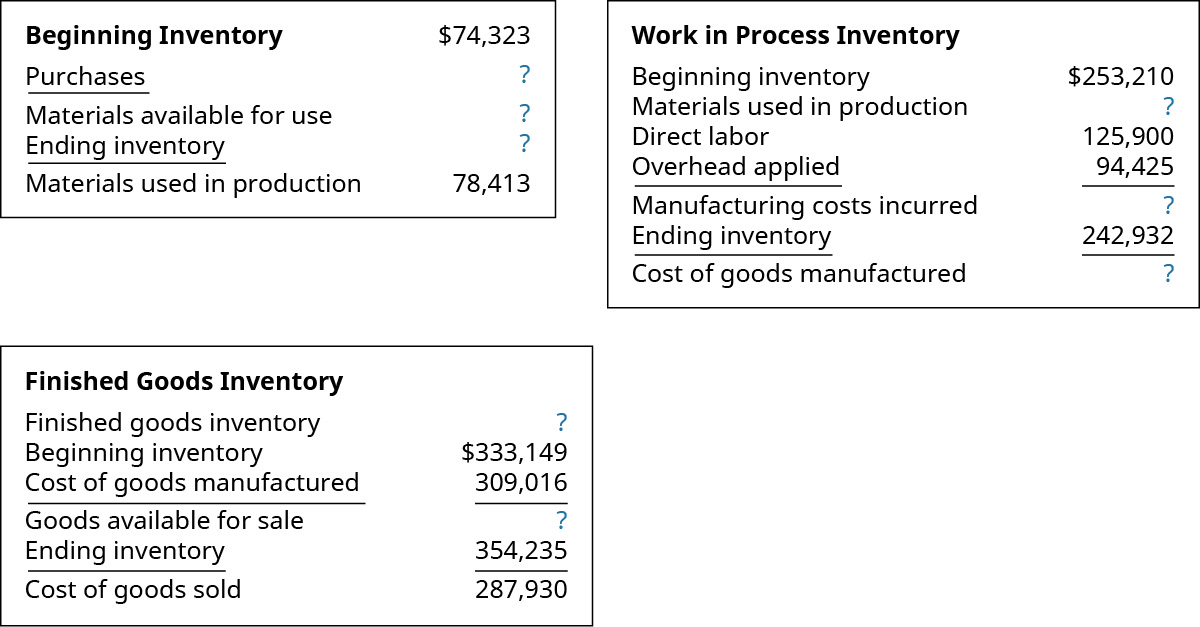

The net purchases are the items youve bought and added to your inventory count.

. The work in process formula is the beginning work in process amount. In the new year you spend 150000 on manufacturing costs. WIP e WIP b C m - C c.

Although WIP inventory cannot yet be sold its considered an asset on a merchants balance sheet. In this example you would calculate your ending WIP inventory as follows. The formula for ending work in process is relatively simple.

Its been moved out of its initial warehousing environment and is now a work in progress. Work in process WIP work in progress WIP goods in process or in-process inventory are a companys partially finished goods waiting for completion and. Work In Process Inventory.

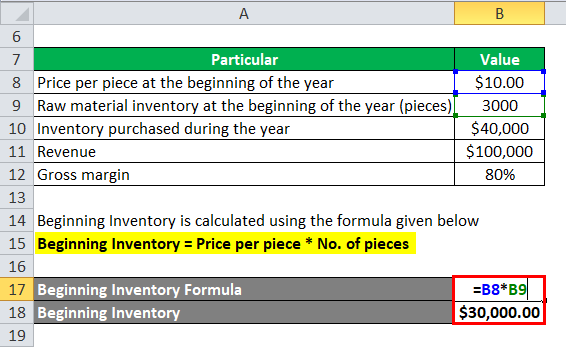

The firms value Ending Inventory calculation is based on any of the three methods mentioned below. Using Weighted Average Cost Ending Inventory Formula. A physical count or a cycle counting program is needed for an accurate ending inventory.

You then spend 150000 on manufacturing costs. Calculating WIP Inventory Examples. Since WIP inventory takes up space and cant be sold for a profit its generally a best.

It is important to note that the methods of calculating ending inventory can only be used for estimating the inventory. Global Tech News Daily. And C c cost of goods completed.

The amount of ending work in process must be derived as part of the period-end closing process and is also useful for tracking the. Click to see full answer. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period.

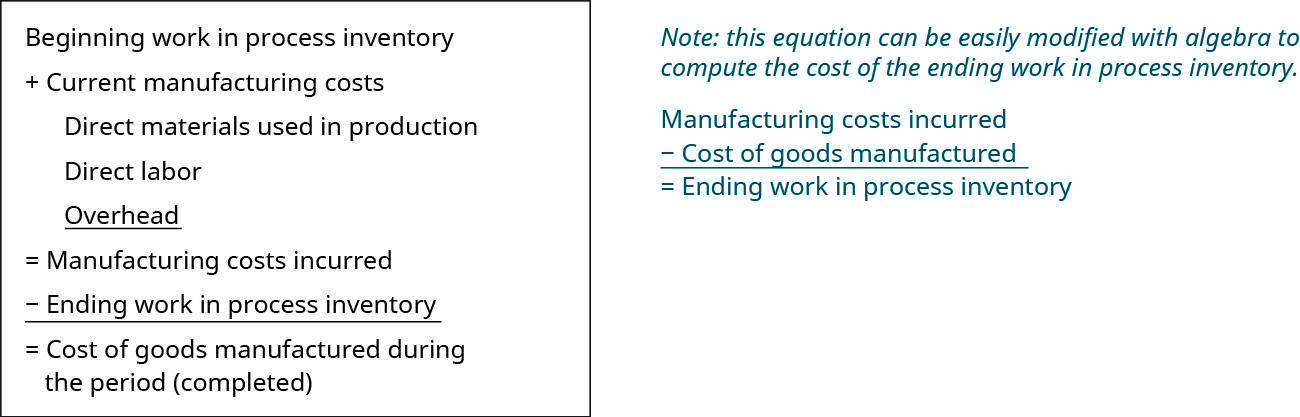

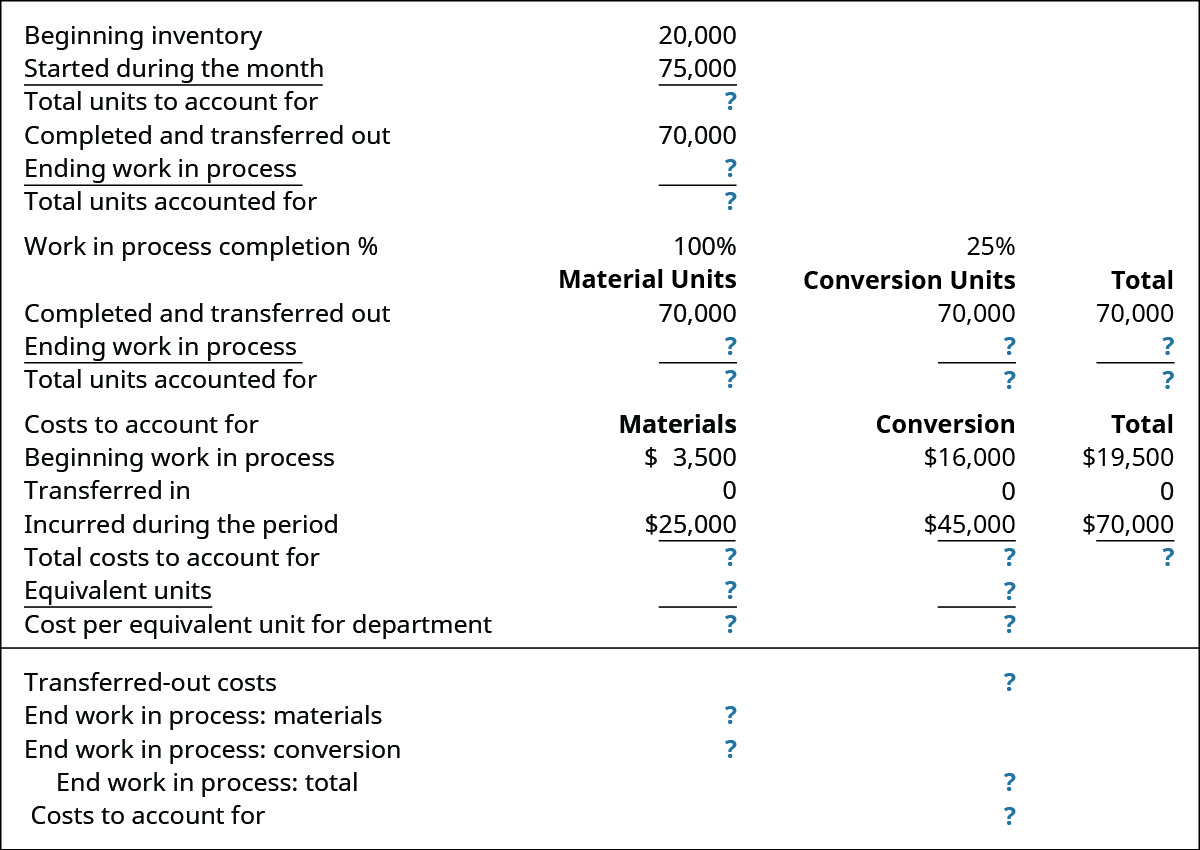

Ending WIP Beginning WIP Materials in Direct Labor Overheads - COGM Ending WIP 25000 40000 10000 5000 - 45000 Ending WIP 35000. In this example the beginning work in process total for June is 50000 the manufacturing costs are 200000 and the cost of goods completed is 170000. Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process.

WIP b beginning work in process. So 1000 x 10 1000 x 15 2000 units 1250. Since the units are valued at the average cost the value of the seven units sold at the average unit.

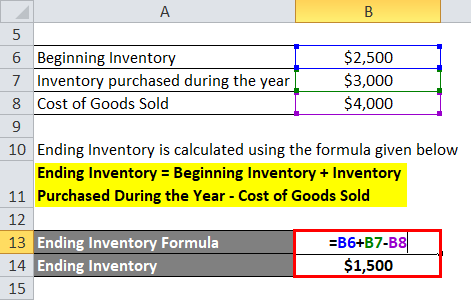

Mathematically ending inventory formula. Here is the basic formula you can use to calculate a companys ending inventory. The ending work in process accounts for the inventory that remains in production at the end of each accounting cycle.

Beginning inventory net purchases COGS ending inventory. The cost of goods sold includes the total cost of purchasing inventory. Definition formula and benefits.

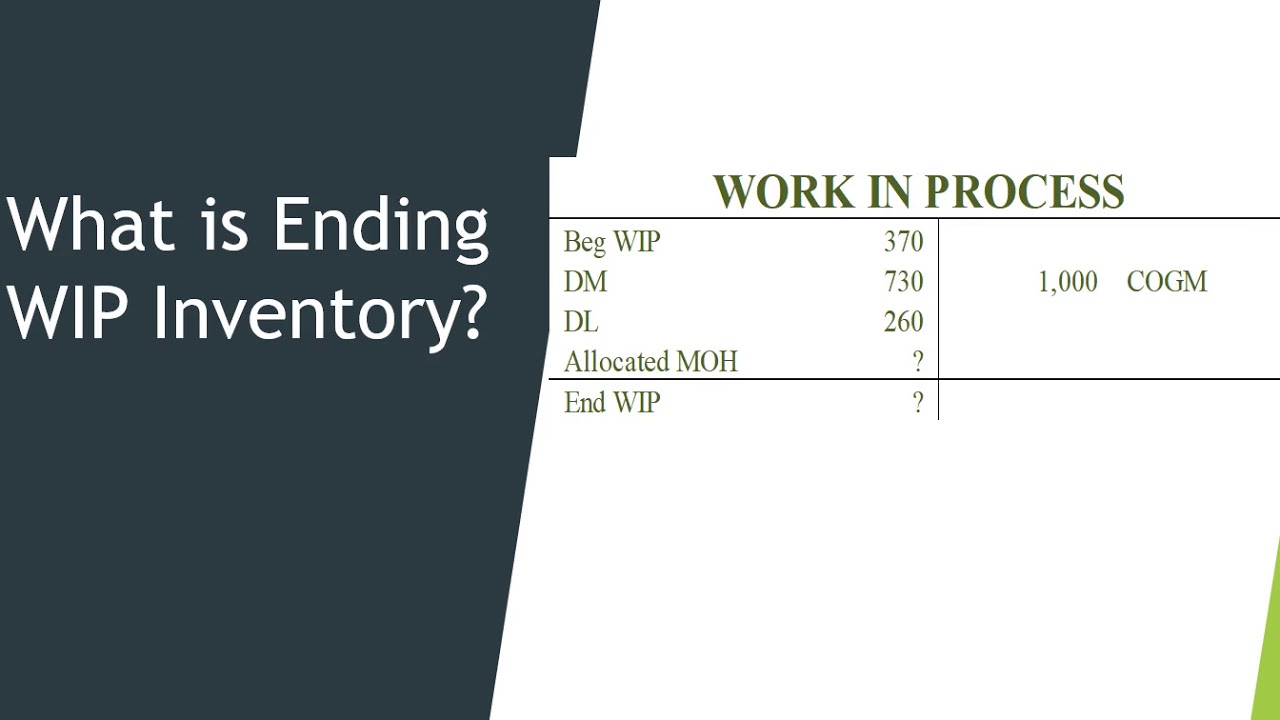

This means that the ending inventory for Bayshore Company is 500 x 1250 6250. For instance if a company follows a monthly accounting cycle and has 45000 in ending WIP at the end of October this. Beginning WIP DM DL MOH.

3 Methods to Calculate the Ending Inventory. Work in process inventory formula. Calculate the ending Work in Process Inventory balance on June 30.

Based on your previous accounting records your companys beginning WIP is 200000. Your beginning inventory is the last periods ending inventory. Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period.

The calculation of ending work in process is. Work in process inventory AKA work in progress or WIP inventory is everything that happens to inventory in between raw materials and finished goods. The weighted-average cost method takes the weighted average of all units in the companys inventory.

Has a beginning work in process inventory for the quarter of 10000. What does work in process mean. WIP inventory includes the cost of raw materials labor and overhead costs needed to manufacture a finished product.

15000 225000 215000 25000. In this equation WIP e ending work in process. In this manner how do you calculate ending work in process inventory balance.

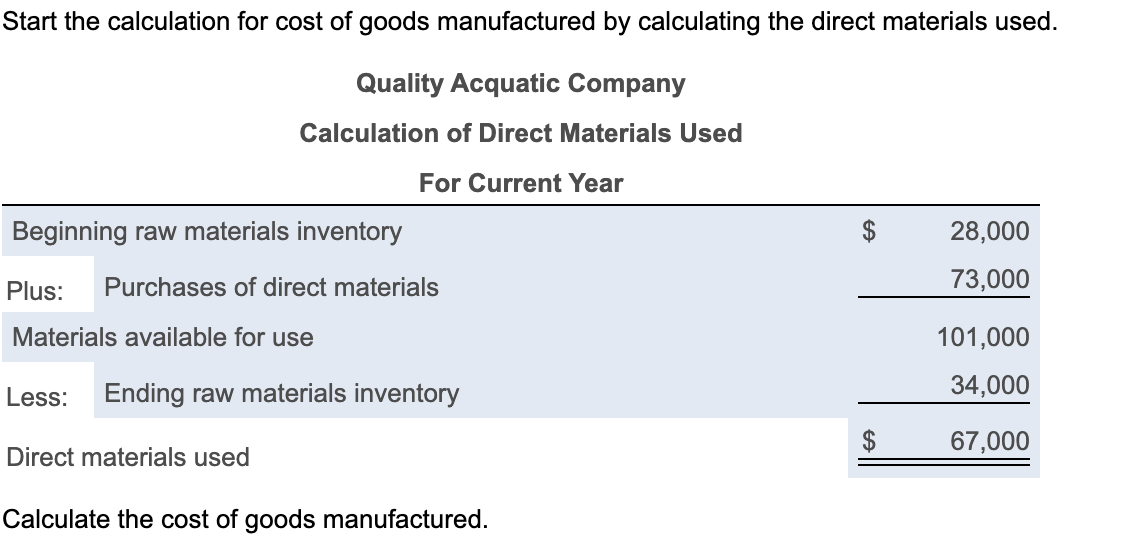

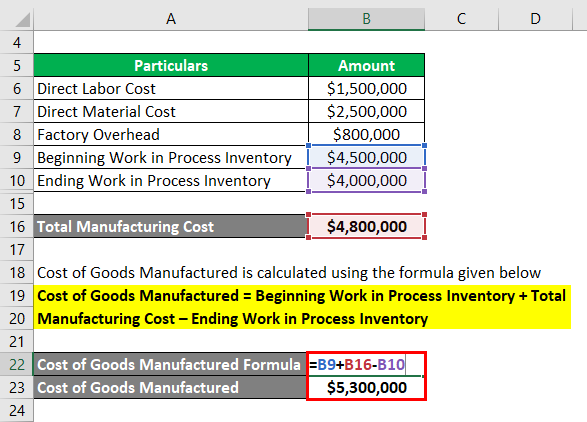

For a more comprehensive example lets say you run a shoe brand with a beginning WIP of 100000. Beginning inventory is the dollar value of all inventory held by a business at the start of an accounting period and represents all the goods a business can put toward generating revenue. The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods.

The work in process formula is the beginning work in process amount plus manufacturing costs minus the cost of manufactured goods. How to Calculate Ending Work In Process Inventory. So your ending work in process inventory is 10000.

Lets calculate Company As ending WIP inventory as per the formula. The basic formula for calculating ending inventory is. The work in process formula is.

The Role of Work in Process WIP Inventory in the Supply Chain. Beginning inventory net purchases COGS ending inventory. The ending work in process is now calculated using the work in process inventory formula as follows.

Once these steps have been completed the expenses can be divided by. At that point the inventory is no longer raw. In this formula your beginning inventory is the dollar amount of product the company has at the onset of the accounting period.

Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory. Imagine BlueCart Coffee Co. The formula for ending inventory is derived by adding inventory at the beginning of the year to inventory purchased during the year and deducting the cost of goods sold incurred during the manufacturing process.

Work in Process WIP Finished Goods. What is the Ending Work in Process Formula. Your manufacturer also produced 5000 pairs of shoes each costing.

Ending WIP is listed on the companys balance sheet along with amounts for raw materials and finished goods. WIP inventory example 2. The manufacturing costs incurred in this quarter are 200000 and the cost of manufactured goods is 100000.

In this example the beginning work in process total for June is 50000 the manufacturing costs are. C m cost of manufacturing. Again this can be summarized as follows.

Here are some simple examples to better understand WIP inventory. COGM Ending WIP Inventory. WIP Inventory Example 1.

Lets use a best coffee roaster as an example. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods. The ending inventory also includes the raw material and other work-in-progress which will.

Work-In-Process Inventory Formula. This is when the. The formula of ending work in progress can be shown as under- For example lets assume that a company XYZ has a work in process inventory of 5000 the manufacturing cost of the company is 29000 for that month and the cost of goods manufactured are 30000 for that month.

The last quarters ending work in process inventory stands at 10000.

Ending Inventory Formula Calculator Excel Template

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Cost Of Goods Manufactured Formula Examples With Excel Template

Explain And Compute Equivalent Units And Total Cost Of Production In A Subsequent Processing Stage Principles Of Accounting Volume 2 Managerial Accounting

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

Work In Process Wip Inventory Youtube

Solved Beginning Of Year Raw Materials Inventory Chegg Com

Cost Of Goods Manufactured Formula Examples With Excel Template

Cost Of Goods Manufactured Formula Examples With Excel Template

Ending Work In Process Double Entry Bookkeeping

Wip Inventory Definition Examples Of Work In Progress Inventory

Ending Inventory Formula Step By Step Calculation Examples

Ending Inventory Formula Step By Step Calculation Examples

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

Cost Of Goods Manufactured Cogm How To Calculate Cogm